Whoa!

I remember watching a friend copy a whale’s trades and win big, and that image stuck.

Trading used to be solitary; now it feels like passing notes in a crowded classroom where everyone’s trying to be the teacher.

My instinct said this is both brilliant and dangerously seductive, because somethin’ about automation reduces the friction for bad habits.

Longer-term, those habits compound and shape a trader’s behavior in ways that are subtle but real, changing risk profiles quietly while you sleep.

Really?

Copy trading made me think differently about social proof and accountability.

Most platforms let you follow top performers like celebrities follow other celebrities, which is useful but noisy.

Initially I thought copying was a shortcut to learning, but then I realized it can be an echo chamber that amplifies mistakes.

On one hand, you’re delegating execution to someone with a track record; though actually, that track record rarely contains the whole story about drawdowns and context.

Hmm…

Lending feels conservative in comparison, and that comforts a lot of investors looking for stable yields.

Earning yield by lending crypto can act like a seatbelt in volatile markets, a modest steady edge that cushions turbulence.

My experience is that platforms often advertise APYs that are very very attractive, which makes people overlook counterparty risk.

If the counterparty is a centralized exchange with opaque balance sheets, ironically your “safe” income could disappear faster than you expect when stress hits.

Here’s the thing.

Trading bots are the workhorses that actually create many of the opportunities copy traders and lenders capitalize on.

A well-designed bot executes strategies without emotion—no fear, no FOMO, no late-night panic selling.

That mechanical discipline is powerful, but it’s not magic; bots are only as good as the rules and data they receive, and when markets shift they can break in ugly ways.

I’ve seen mean reversion bots puke through stops during black swan moves, and bots tuned to stable ranges crumble in trending melt-ups, which shows you can’t set and forget.

Table of Contents

How Copy Trading Really Works (and What It Hides)

Whoa!

Copy trading maps another trader’s actions onto your account, often proportionally and in near real time.

You get exposure to their entry points, their exits, and sometimes their leverage choices, but you rarely get their reasons.

This asymmetry matters a lot because context—position sizing, time horizon, risk limits—isn’t fully transmittable through trades alone.

So while copying can accelerate learning, it also transfers someone else’s conviction and mistakes directly to your P&L without teaching you how to manage them.

Really?

Performance lists are seductive.

They present returns but rarely show sequence risk—the order of wins and losses—and that sequence defines survivability.

Actually, wait—let me rephrase that: a trader with sporadic 200% months and deep drawdowns might look like a hero on a leaderboard, but they could be on a path that would have wrecked you two years in.

That’s the hidden selection bias of public leaderboards, where survivorship and recency skew perception.

Why Lending Isn’t Just Passive Income

Whoa!

Lending crypto to exchanges or protocols can seem boring compared to trading, which is why many people like it.

It provides yield and reduces active oversight, but the yield is payment for liquidity and risk, not a guarantee.

If an exchange uses your lent assets for margin or custody and something goes sideways, recovery depends on legal structures and insolvency processes that vary widely.

I’m biased toward transparency—give me clear terms over flashy APYs any day—because when markets seize up, disputes get messy and fast.

Seriously?

Collateralization rules matter.

When you lend, whether assets are rehypothecated or segregated changes everything.

On one hand you want your capital to be productive; though actually, the safest lenders are often those who accept lower yields in exchange for strict segregation and audited reserves.

That’s the tradeoff between yield and real counterparty assurance.

Trading Bots: Your Best Ally or Your Quiet Enemy?

Whoa!

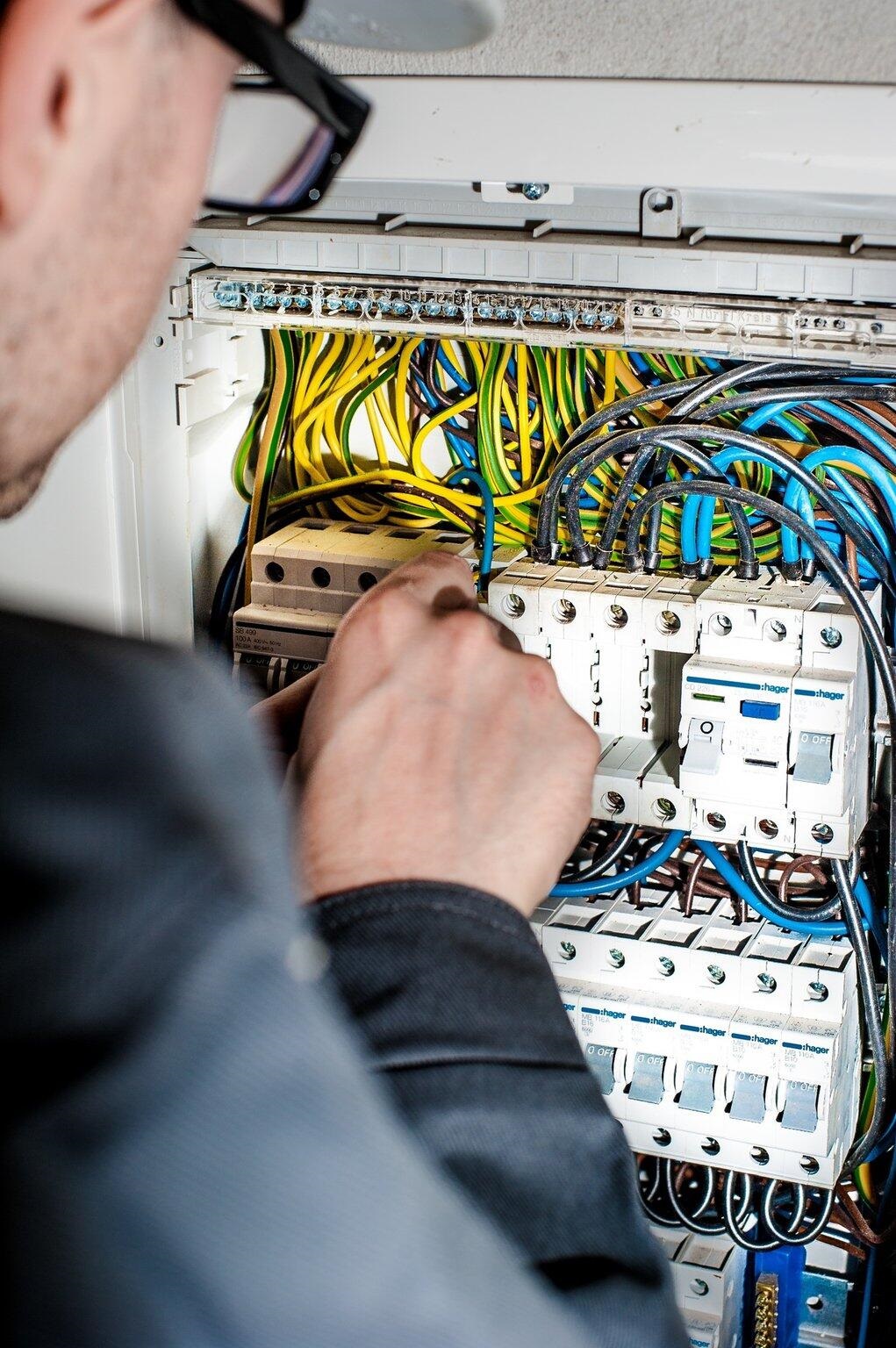

Bots remove emotion from execution, which is a big win for disciplined strategies.

They can scale strategies across time zones, running micro-adjustments far faster than a lone human could.

But they also run continuous processes that can accumulate small inefficiencies into big losses, and when a data feed hiccups a bot might act on garbage.

So you must monitor and stress-test; otherwise a silent failure becomes an expensive surprise.

Hmm…

My instinct said automated strategies would democratize edge, and to some degree they have.

Yet I’ve seen copy pools where bots amplify the same signals and create fragile correlations across portfolios—crowding risk, plain and simple.

On one hand automation multiplies capability; though actually, when everyone uses similar rule-sets, liquidity evaporates at the same time and the bots fight each other with predictable results.

That crowding risk is underrated by retail traders who look only at returns not at behavioural overlap.

Practical Rules I Use (and Tell People About)

Whoa!

Diversify across strategy types, not just asset types.

That means mixing copy trades from different styles, some lending allocations, and bots with distinct timeframes.

I keep allocations modest to any single strategy’s manager—call it the 10-20% rule—because even high-performing systems fail.

Also, I insist on clear transparency: performance history, drawdown records, and preferably verifiable proofs of execution; if you can’t verify, treat returns as marketing and act accordingly.

Really?

Backtesting is necessary but insufficient.

Walk-forward testing and live-sim trials reduce the chance you buy overfit performance.

Initially I trusted backtests a little too much; then a few live-market surprises taught me humility, which was expensive but instructive.

That’s part of learning—making mistakes and updating rules until you build durable processes, not brittle ones.

Here’s the thing.

If you use centralized exchanges, platform choice matters because custody, collateralization, and execution latency vary widely.

Check the exchange’s disclosures, audits, insurance coverage, and whether they offer clear lending agreements or a simple click-through that’s vague as a fortune cookie.

Personally I keep an eye on well-known platforms that publish proof-of-reserves and transparent fee structures; for example, when I’m comparing execution quality and product breadth I often look at offerings on the bybit exchange to understand how different features integrate.

That comparative approach helps me pick the right tools for copy trading, lending, or deploying bots without overconcentrating risk.

FAQ

Is copy trading safe for beginners?

Short answer: it can be educational but it’s not a shortcut to mastery.

Follow with low allocations, pick traders with transparent histories, and monitor their positions yourself until you understand their behavior.

Also, don’t ignore counterparty risk: where your assets are held matters as much as who you copy.

Should I lend my crypto on an exchange?

Lending can diversify returns, but treat yields as compensation for liquidity risk.

Prefer platforms with clear custody rules and audited reserves, and be ready to pause lending in volatile regimes.

If you need constant access to principal, lending might not be the right tool—consider short-term structures instead.

How do I avoid bot-related blowups?

Run bots in simulation first, enforce stop-loss and kill-switch mechanisms, and diversify across logic types.

Keep human oversight and regular reviews; automation amplifies both your good ideas and your mistakes.

And for heaven’s sake, monitor your data feeds—garbage in, garbage out, always.