Buying your first home is an exciting milestone, but it can also feel overwhelming. From understanding finances to closing the deal, the home buying process involves many steps that may be unfamiliar to first-time buyers.

With the right preparation and guidance, however, you can move forward confidently and make informed decisions along the way. Read on.

Understand Your Financial Readiness

Before you start browsing listings, take a close look at your financial situation. Review your savings, monthly income, expenses, and credit score. Your credit score plays a major role in determining the mortgage options and interest rates available to you.

Lenders typically prefer borrowers with stable income and manageable debt. Next, determine how much you can afford.

This includes not only the home’s purchase price but also additional costs such as property taxes, insurance, maintenance, and homeowners’ association fees. Getting pre-approved for a mortgage is a smart early step, as it clarifies your budget and shows sellers that you’re a serious buyer.

Define Your Needs and Priorities

Once your finances are in order, identify what you’re looking for in a home. Consider factors such as location, size, layout, and proximity to work, schools, or public transportation. Separate your “must-haves” from your “nice-to-haves” to avoid feeling overwhelmed by choices.

It’s also important to think long-term. Will the home still meet your needs in five or ten years? Planning ahead can help ensure your purchase remains a good fit as your lifestyle evolves.

Work With the Right Professionals

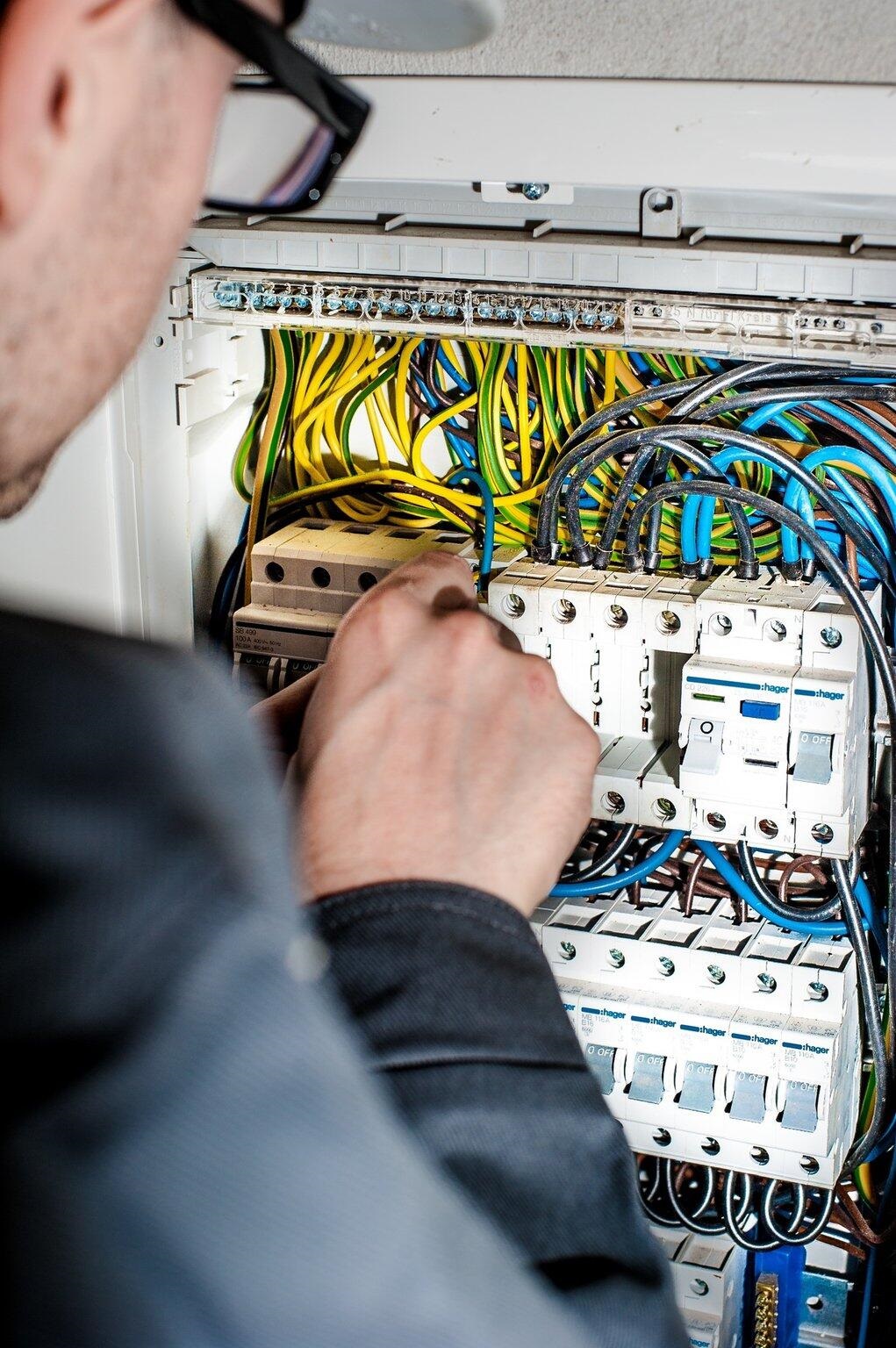

A knowledgeable real estate agent can be a valuable ally, especially for first-time buyers. An experienced agent understands local market trends, negotiates on your behalf, and guides you through paperwork and deadlines. Similarly, working with a trusted mortgage lender and home inspector can help prevent costly surprises later in the process.

Don’t hesitate to ask questions. Buying a home is a major investment, and professionals are there to help you understand each step clearly. Check out theeasyhomebuyer.com to learn more.

Make an Offer and Navigate Negotiations

When you find the right home, your agent will help you submit a competitive offer based on market conditions and comparable sales. Be prepared for negotiations, which may involve price, repairs, or closing timelines. Flexibility and patience are key during this stage.

Once your offer is accepted, you’ll move into the due diligence phase, which typically includes a home inspection and final mortgage approval. Address any issues promptly to keep the process on track.

Close the Deal With Confidence

The final step is closing, where legal documents are signed, and ownership is transferred. Review all paperwork carefully, confirm closing costs, and ensure funds are ready. After closing, you’ll receive the keys to your new home-marking the start of an exciting new chapter.

Your Next Step in the Home Buying Journey

While the home-buying process may seem complex, preparation and education make it manageable. By understanding your finances, setting clear priorities, and working with the right professionals, first-time buyers can navigate the journey with confidence and turn the dream of homeownership into reality.

If you want to read more articles, visit our blo