Real estate crowdfunding has surged in popularity by enabling everyday investors to fund real estate projects for dividends and equity. This innovative model provides portfolio diversification traditionally limited to wealthy investors. Through online platforms, individuals can browse and invest in vetted real estate offerings. However, understanding how real estate crowdfunding works and key considerations is crucial before investing as a beginner.

Table of Contents

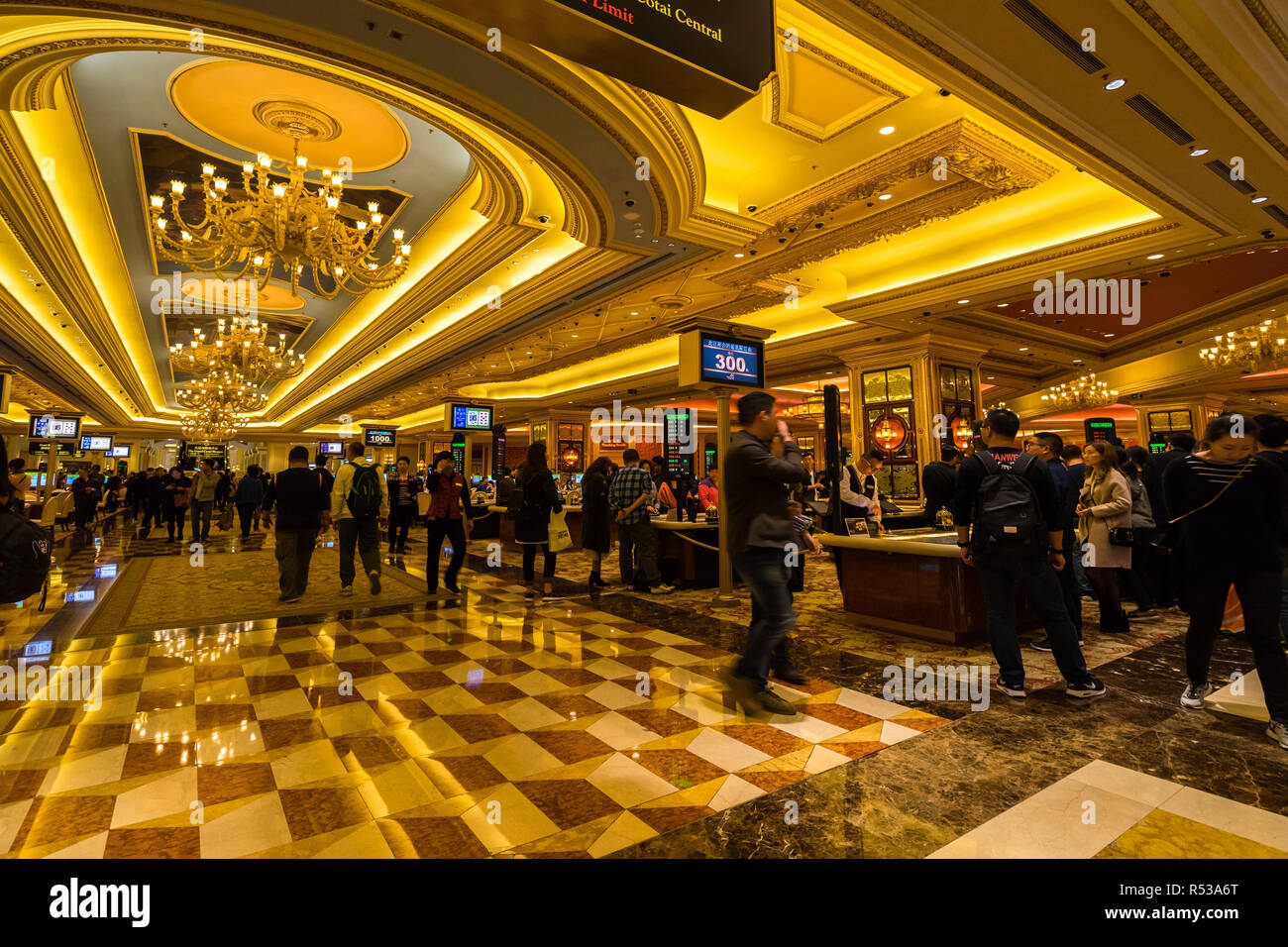

How Real Estate Crowdfunding Works

Real estate developers and operators work with crowdfunding platforms to raise capital for acquisitions and projects. Investors browse listed offerings on the site and select deals to invest in, typically for minimums of $500-$5,000. Pooling many investors provides the project with full funding. Major platforms vet sponsors, properties, and deal terms for quality. Investors become limited partners owning equity, not physical property. Annual dividends and eventual principal repayment provide returns.

Types Of Real Estate Crowdfunded

While early real estate crowdfunding focused mainly on individual property deals, options have expanded. Common real estate crowdfunding categories now include:

- Rental properties like apartments, single-family rentals

- Commercial properties like malls, offices, storage

- Real estate funds and REITs

- Real estate debt like mortgages, bonds

- Ground-up development projects

This diversity allows tailored investing in favored sectors or geographies. Review deals closely since risks and returns differ.

How Investors Make Money

Investors in crowdfunded real estate earn returns in two main ways. First, regular dividend payments based on property income provide consistent income, usually quarterly or annually. Second, gains from the property’s sale or refinance may offer profit sharing. While not guaranteed, targeted returns often range from 8-12% annually. Real estate crowdfunding tax benefits also exist like depreciation write-offs that reduce taxable income from dividends.

Risks To Consider

While enticing, real estate crowdfunding carries substantial risks. Many deals are equity investments, meaning limited recourse if the property underperforms. Economic downturns lowering property value is a threat. Platforms spreading offerings across many deals helps mitigate risk. Concentrating too heavily on certain sponsors or markets magnifies risk, so diversify. Invest only discretionary funds given illiquidity timing exits.

Vetting Sponsors And Deals

Given the risks, closely evaluating sponsors and deal specifics is crucial. Review the sponsor’s track record, expertise, transparency, and governance. Analyze the business plan, projected returns, location, debt levels, and tenancy for red flags. Compare terms to other deals on the platform and realistic market rates. Ask questions and request documentation to ensure thorough due diligence before investing.

Minimums And Fees

Real estate crowdfunding allows access to deals otherwise requiring huge minimums. But most platforms still have minimum investments, often $500-$5,000. This expands access while requiring meaningful commitment. Various fees also apply such as the platform fee, typically 1-2% of capital raised. Some platforms also take a percentage share of sponsor profits. Factor all costs into projected returns.

Liquidity Challenges

Crowdfunded real estate investments are highly illiquid, with terms often 5-10 years or more. Investors’ funds remain tied up until the deal reaches the exit. Early exit options are usually non-existent or come with penalties. This locks up capital for longer timeframes. Some platforms offer limited liquidity through potential matching with new investors. But illiquidity remains a key constraint.

To Wrap Up

Real estate crowdfunding lets individuals access income-generating real estate deals online. However sufficient due diligence on sponsors, properties, and terms is vital to manage risks and fees. While innovative, real estate crowdfunding has tradeoffs to weigh like illiquidity. With education and prudent investing, crowdfunding can supplement portfolios through increased diversification.

Related Post: How to Read a Merchant Statement: A Complete Guide