Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Table of Contents

Reimbursement Policy: IRS Accountable Plan and Regulations Compliance

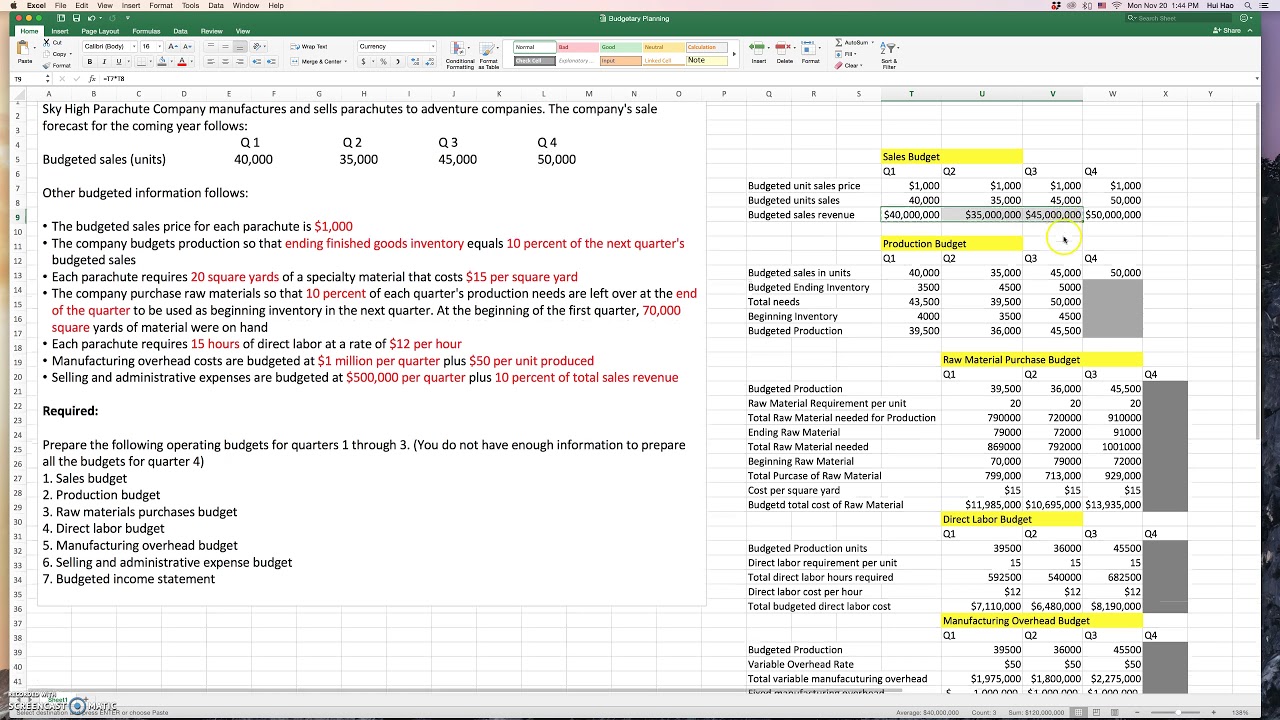

- SG&A costs are typically the second expense category recorded on an income statement after COGS, like on this simple income statement for XYZ Soaps Inc.

- Reporting and accounting software should be able to pull out these expenses and correctly assign them to the SG&A category.

- OPEX is not included in the cost of goods sold (COGS), which consists of the direct costs involved in the production of a company’s goods and services.

- Therefore, maintaining a healthy SG&A expense ratio not only benefits the business but also enhances its reputation and attractiveness to potential investors.

SG&A, or “selling, general and administrative” describes the expenses incurred by a company not directly tied to generating revenue. First, we use the budgeted unit sales off of the sales budget we created first! Our bookkeeping team completes your books and generates a monthly income statement and balance sheet for you. Bench’s easy-to-use software let’s you quickly see how your business is doing so you can make smarter decisions with your money and master your spending. They work with our client research team to get the answers you need to make informed decisions for your business strategy.

What Are Selling, General, and Administrative Expenses (SG&A)?

So we are going to make some assumptions so we can start work on this budget. SG&A costs are reported on the income statement, the financial statement that your business selling and administrative expense budget prepares to figure out how profitable it is. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

What Is Included in Operating Expenses?

Finally, businesses may overlook the importance of employee training and education when it comes to managing SG&A expenses. Employees who are not properly trained on expense tracking and management may make mistakes or miss opportunities to save money. By investing in employee education and training, businesses can ensure that everyone is on the same page and working towards the same goals. Operating expenses and SG&A aren’t directly tied to how many goods or services were sold and produced.

By avoiding these mistakes, businesses can better manage their SG&A expenses and improve their financial performance. The SG&A expense ratio is an important financial metric that helps businesses track their operating costs and determine how efficiently they are using their resources. The resulting percentage indicates what portion of a company’s revenue is being spent on SG&A expenses. A lower ratio indicates that the business is effectively managing its expenses and is operating more efficiently. The selling and administrative cost budget lists operating expenses on a line-by-line basis and totals the amounts.

b. Timeliness of Transaction

For some categories of business expenses, such as business meals, the university has established maximums, which are regularly reviewed and updated in alignment with pricing indices. Schools and units are responsible for approving any transaction that exceeds these maximums. In general, business expenses for persons not directly connected to the business purpose are not reimbursable (e.g., spouses, other family members). A business connection exists when expenses have been paid or incurred while performing university business. The business connection should be justified through the business purpose and supporting documentation.

Because of this dynamic, a manager analyzing these numbers should make sure to distinguish between the company’s baseline fixed costs and the incremental variable costs that rise and fall over time. The variable expenses could be correlated to sales, to head count, or even to capital spending. A proper analysis must dive into this level of granularity to fully understand how the company’s strategy and tactics will influence its expenses. Typically, the operating expenses and SG&A of a company represent the same costs; those independent of and not included in the cost of goods sold. However, sometimes SG&A is listed as a subcategory of operating expenses on the income statement.

Selling, general, and administrative expenses (SG&A) also consist of a company’s operating expenses that are not considered direct costs of production or cost of goods sold. While this is typically synonymous with operating expenses, often companies list SG&A as a separate line item on the income statement below the cost of goods sold, under expenses. In other words, administrative expenses are a subset of operating expenses and can be listed as G&A to separate selling expenses from the general administrative costs of running the company.

Another way to reduce costs is to streamline processes and eliminate bureaucracy within the organization. By examining your current operations and pinpointing areas where expenses can be trimmed, you can make significant savings and operate leaner and more efficiently. It is important to note that while SG&A expenses are necessary for the day-to-day operations of a business, they can also be a significant burden on profitability.

For more information about paying for travel, see Purchasing and Payment Methods on Fingate. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Get instant access to video lessons taught by experienced investment bankers.

Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. SG&A expenses as a percentage of revenue are generally high for healthcare and telecommunications businesses but relatively low for real estate and energy.