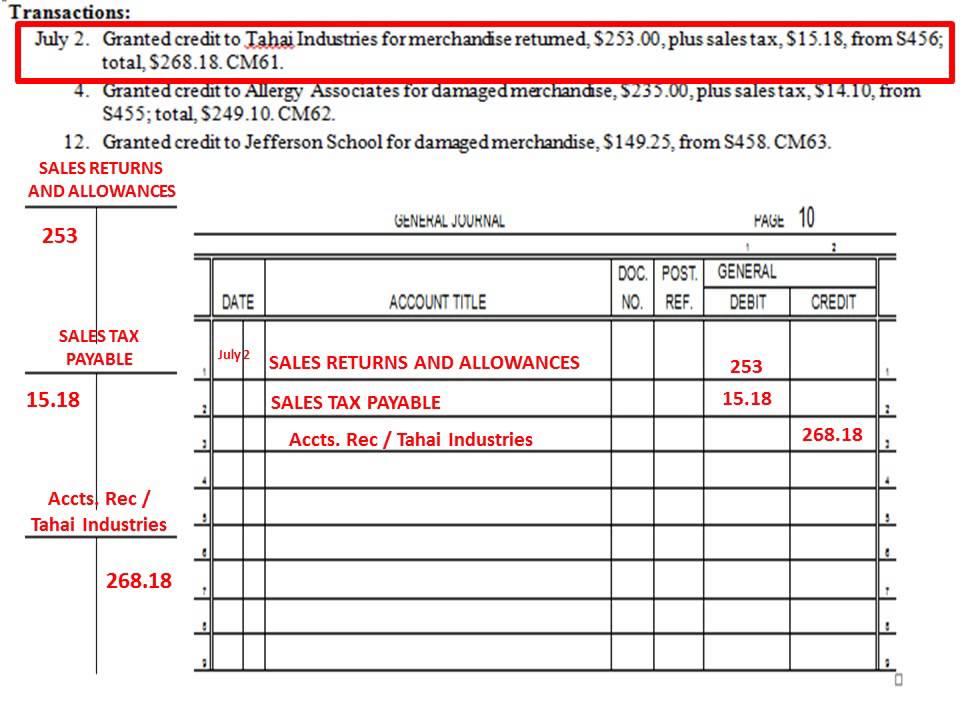

Debit The amount owed to the supplier would have been sitting as a credit on the accounts payable account. The debit above cancels the amount due and returns the suppliers balance to zero. The refunds and allowances discussed above are accounted for by maintaining an account known as the sales returns and allowances account. If it were the credit sales, then we should credit to the account receivable account. If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- However, if the purchase was made in cash, it can be seen that Cash would have been debited (because the company would have received cash against the returned purchase material).

- The Debit Balance will then offset this credit balance in the Purchase Account.

- This is due to, under the perpetual inventory system, we need to update the inventory perpetually (i.e. whenever there is an increase or a decrease of the inventory).

Table of Contents

Popular Double Entry Bookkeeping Examples

To have an up-to-date inventory report helps companies to run their accounting and logistics departments without hassle. Let us understand the importance of passing the goods purchase return journal entries from the company’s point of view. Sometimes goods purchased by a business are unfit for use and may need to be returned to the respective supplier(s). This may happen due to several different reasons, in business terminology, this action is termed purchase returns or return outwards. Journal entry for purchase returns or returns outwards is explained further in this article. But if you don’t know how to account for a return with a purchase returns and allowances journal entry, your books will be inaccurate.

How confident are you in your long term financial plan?

The corresponding accounts are credited with the amounts debited to balance the entries. The entries are based on cash or on credit as the respective accounts have to be credited back due to the return. For the seller, revenue can be revised by debiting the sales return account (A contra account by nature) and crediting cash/accounts receivable with the invoice amount.

Best Account Payable Books of All Time – Recommended

Hence, the overall value of the goods that are recorded is essentially deducted from the purchases that have been made. Purchase Returns or return outwards can be seen as a process where goods are returned to the supplier because of being defected or damaged. Unreal Corporation purchased raw materials worth 90,000 on credit from ABC Corporation. However, at the time of delivery of the goods 5,000 worth of goods were found unfit because of inferior quality. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Because you are not immediately paying the customer, you must increase the amount you owe through an Accounts Payable entry.

This is typically done by customer service or a dedicated returns department. Once the item has been received, it must be inspected to determine the cause of the return. If it is due to damage or an error on the part of the retailer, a refund or replacement should be issued immediately.

In this journal entry, the purchase returns and allowances account is a temporary account, in which its normal balance is on the credit side. This account will be cleared with the purchases account at the end of the accounting period. This is usually the case where customers return goods due to they are damaged or defective. In this circumstance, the sales returns and allowances and related accounts are recorded the same as above journal entry. If you need to refund a customer for a purchase they made from your business, you will need to create a purchase return journal entry. This will help you track the returned merchandise and ensure that the vendor or supplier provides you with a credit for the returned items.

In most cases, the customer receives a refund when they physically return the good. You can also lay out a return time frame in your payment terms and conditions. So once this entry is posted, inventory will be increased, and the cost of goods sold will be derecognized. Once the buyer identifies these problems, the buyer will normally need to return the break even point calculator bep calculator online goods and then ask for returning cash or reducing the credit balance. Therefore, to summarize the explanation given above, it can be seen that Purchase Returns are an accounting concept that reflects the return of goods to their supplier because of legitimate concern. Purchases Returns would have been credited (since it is a company expense decrease).

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.